We are experiencing some significant shifts in the Texas real estate landscape that are already impacting how business will be done in the post-Covid world.

Below are three of the top trends in our market based on my recent conversations with local developers, landlords, and investors, as well as what I have seen supported by Avison Young’s global research and perspectives.

Rising Construction Costs

We are currently seeing soaring construction materials costs, especially lumber. Unfortunately, the pandemic did not usher in any kind of “rebalancing” in the cost of materials. In a recent meeting with my friends at Phoenix Construction, I learned that steel framing is now cost-competitive with wood framing.

Concrete delivery lead times are stretching into weeks, complicating construction schedules. Steel prices have increased, with longer delivery times adding to construction schedules. Developers and contractors have to be increasingly flexible and innovative to make a new development project pencil. Labor costs have continued to rise, and there is a worsening shortage of skilled plumbers and electricians entering the workforce.

Strong Demand for Land

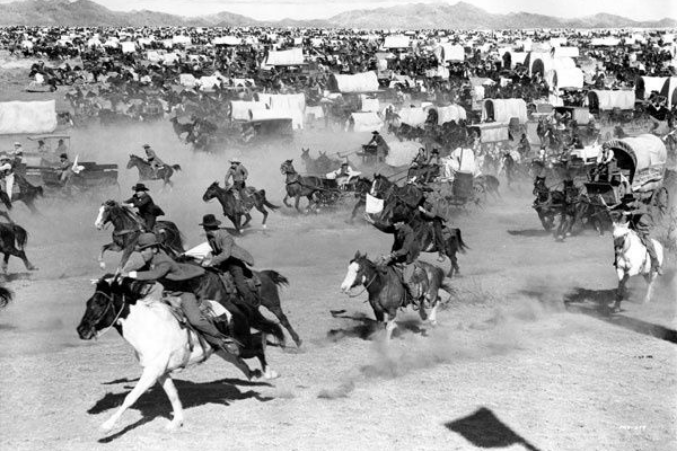

On top of rising construction costs, our land brokerage teams in Dallas and Austin are dealing with insatiable demand to acquire land…the Great Texas land rush of 2021. Developers that formulate an offer based on a pro forma, and the risks of development, are now competing with speculative land buyers and special purpose acquisition companies (SPACs) that are flush with investor cash. As a listing broker, we are getting an overwhelming amount of interest in our land listings, particularly those developers looking to build multifamily, industrial and single-family projects.

On the flip side, as a buyer broker, strong offers from large national and regional developers are being turned down in favor of a cash buyer with no plans for development and little concern about entitlements. Texas land is becoming a high-stakes game of Texas hold ’em, and sometimes it’s wiser to fold and keep looking. As I often discuss with my buyer clients, sometimes the best deal is the one you don’t do.

Build-To-Rent

There is an enormous amount of capital seeking to invest in Build-To-Rent (BTR) or Single-Family Rental (SFR) projects. This product type consists of developments of detached small- to medium-sized homes that that are owned and operated as a traditional apartment complex.

Think of apartments, chopped up and set on the ground, with a gate, lawns, and community amenities. Single-Family Rentals are now competing for our housing dollars with traditional homes, as well as apartments.

Developers of for-sale homes and apartment projects are crowding into the growing sector. There continues to be a shortage of entry-level housing, in part due to the NIMBY (not in my backyard) approach by cities to all types of rental housing. This makes it difficult to get parcels rezoned for Single-Family Rental development, driving up, you guessed it, land prices.

The strong fundamentals of living and doing business in Texas continue to attract capital and buyers.

We have seen that many developers that have been doing business in other parts of the country are now permanently relocating here. The trick will be to make development deals pencil in the face of higher construction costs and escalating land price expectations.

Michael Kennedy is a Capital Markets Principal at Avison Young and Development Principal at Altera Development.